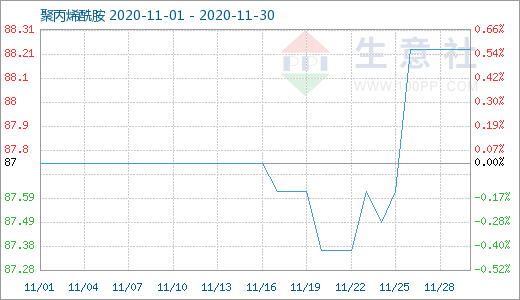

on November 29, the polyacrylamide commodity index was 88.23, unchanged with yesterday, 17.64% lower than 107.13 (2019-05-08), and 6.44% higher than the lowest point of 82.89 on August 02, 2020. (Note: Refers to the period from April 1, 2019 to now)

Polyacrylamide Price Nov 2020

Industrial Chain

Upstream: This month, acrylonitrile has risen dramatically. At the end of October, the mainstream quote for domestic acrylonitrile was 9300 yuan / ton, according to chemnet.com. The price of acrylonitrile has been repeatedly increased this month, with a single 400-500 yuan/ton increase and a weekly 2000-3000 yuan/ton increase. The mainstream is currently about 12250 yuan / ton, and the growth is as high as 1950 yuan / ton this week. This month’s acrylonitrile unit situation: Sinopec’s settlement price for acrylonitrile products sold in November was 9900 yuan/ton in North China and 9850 yuan/ton in East China; Zhejiang Petrochemical Company had a maintenance schedule for its 260000 ton acrylonitrile unit in December and a further determination of the particular situation is needed;Sinopec’s 240,000 ton acrylonitrile plant in Kaohsiung, Taiwan, delayed the restart until 25 November and the plant was shut down for maintenance on 20 October after the 130,000 ton acrylonitrile unit of Shandong Haijiang Chemical Co., Ltd. was shut down in early August. Downstream: The number of downstream water treatment plant building businesses is declining in the current winter, and demand for raw materials is week.

The Industry

Since 2020, the prosperity of the water treatment industry for environmental protection has not recovered substantially. During the period from January Spring Festival holidays to February 20th, the related undertakings halted activity in the major production areas and postponed their resumption of operation. The factories in the major manufacturing areas steadily returned to work and production after February 20. Logistics returned to normal in March, primarily absorbing inventory. Manufacturers survived normally in April, and the cost of raw materials was decreased in part and demand was weak, resulting in a strong inventory of manufacturers. The national high-speed fee recovery on May 6 raised the price of acrylonitrile and other raw materials, the ex-factory price of polyacrylamide did not improve much, and there were more stocks; the upstream acrylonitrile propylene increased the output potential of acrylonitrile in the industrial chain relationship of the ‘propylene PP melt blown cloth mask. Acrylonitrile’s output potential, which contributed directly to the firm price of acrylonitrile. The price of acrylonitrile was reduced dramatically in July, and the cost of polyacrylamide was reduced. Some companies, according to the pattern, lowered the price of their goods and then rebounded in the second half of the month.

However, the prices of manufacturers did not change significantly. In fact, most manufacturers hoarded raw materials, and the cost of purchasing determined the price and cost. In August, acrylonitrile continued to rebound slightly, and then continued to stabilize. In September, it remained stable after a small shock, and the amplitude of the shock was insignificant, and the demand did not rise significantly. Although the prosperity of the industry increased in October, the price changes of different water treatment products were quite different. The ex factory price of polyaluminum chloride increased by 7% in September and October due to the rising prices of raw materials and fuels. Although the price of polyacrylamide raw materials also increased, the market price of polyaluminum chloride did not rise as much as that of polyaluminum chloride. In November, faced with the big influence factors of heating season this year, polyacrylamide manufacturers stopped production more, and recently faced a sharp rise in acrylonitrile, the downstream demand was weak, the upstream cost was high, the pressure of polyacrylamide manufacturers was large, and the price rise was inevitable.

Forecast

The current domestic economic momentum is strong, the price of acrylonitrile, the upstream raw material, has risen sharply this month, and the cost-side pressure has increased sharply, according to the business agency’s analysis; however, due to the seasonal effects on its production, demand in winter is not good, and downstream support for the price increase is inadequate. In the future, the availability of polyacrylamide will also be impacted when producers stop production before the end of December; and it is reported that polyacrylamide suppliers already have a price raise proposal at the beginning of next month due to the increasing price of acrylonitrile raw material, so we expect the price of polyacrylamide to continue to grow next month; however, due to the seasonal demand and strong purchasing pressure, the transaction will be greatly affected.

Polyacrylamide prices continued to rise in December, but declined slightly. On the whole, affected by supply chain and other factors, it may still rise. Oubo Chemical reminds our customers that if you have any inquiry, please contact us.

Post time: Dec-16-2020